When we think of ‘insurance’, images of countless policies, legalities, and heaps of paperwork come to mind.

However, with the advent of modern technology, the insurance sector is undergoing a makeover.

As consumer behaviors evolve and the demand for transparency grows, more people are turning to digital platforms to purchase policies, check reviews, and compare offerings.

Chatbots are at the forefront of this digital shift in insurance. Studies indicate that nearly 44% of consumers are open to processing insurance claims through chatbots.

Yet, despite the evident demand, the potential of chatbots in the insurance realm remains largely untapped. Many firms are still navigating the technology, evaluating chatbot costs, and determining the best ways to integrate chatbot capabilities into their operations.

If you’re curious about the role of chatbots in the insurance world, you’ve come to the right spot. Dive into this article to gain insights into leveraging chatbots in the insurance sector

Insurance Chatbot Use Cases

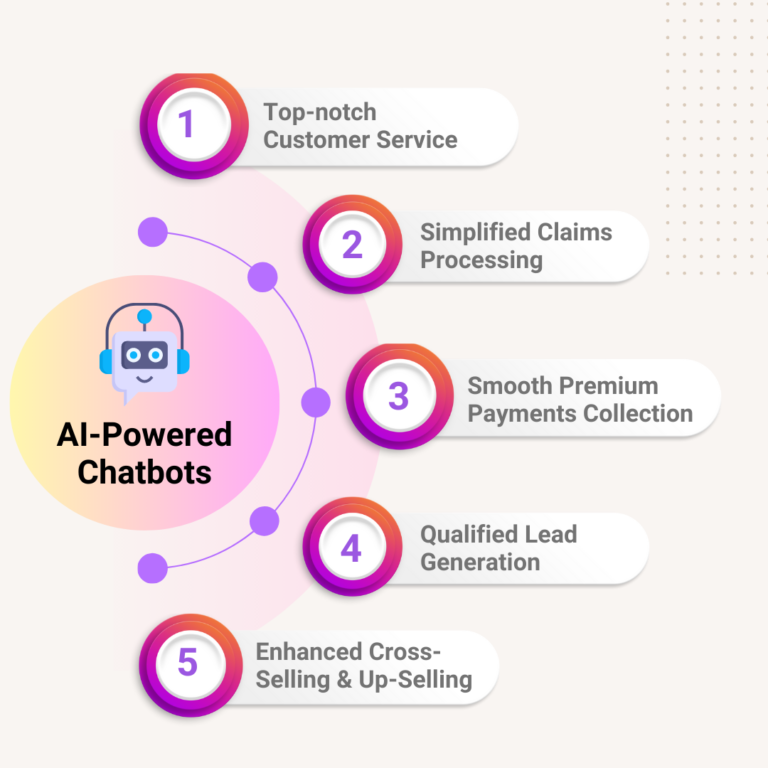

1.Respond to Customer Questions and Attract Potential Clients.

Customers often have many questions about insurance before they decide to buy. They want to know about the different options, rules, and how to claim.

Usually, they’d ask these questions to agents who can tell them about the best choices.

But now, AI chatbots can help answer these questions first. These chatbots know a lot about the company’s insurance details and can give answers quickly.

This means customers get answers faster, and agents don’t have to do simple tasks all the time.

The information from chatbots is also trustworthy.

What’s the benefit?

Chatbots can talk to customers right away, so they don’t have to wait.

More people might buy insurance from your website because they get answers fast.

You can save money because chatbots can answer common questions.

A company called PolicyBazaar is a good example. They sell insurance for home items. They used a chatbot to help answer sales questions and give customer support. This made them get more leads and answer questions 83% faster.

- Handle and Manage Claims.

Handling insurance claims can be slow and frustrating for customers. They often have to wait a long time to talk to someone, fill out forms, and send papers. This whole process can be made faster and easier.

In the old way, agents had to look at many papers and do things by hand. This made everything slow.

But chatbots can make things faster. If someone wants to make a claim, the chatbot can quickly check it and tell them how much money they might get back.

Customers can also send pictures or videos of the damage right in the chat. The chatbot can then quickly send this for review. People like things to be fast, and chatbots can do that.

Imagine if there’s a big event, like a storm, and many people need to make claims at once. This could be too much for a team to handle quickly. But with chatbots, many claims can be checked at the same time, making things smoother for everyone

- Provide Advice and Information

Insurance is something people need, but not always something they want. The first step in insurance is asking questions. Companies should teach customers about insurance so they understand why it’s important.

That’s what insurance salespeople do. They explain things to potential customers. Even if someone doesn’t buy insurance right away, talking with an agent helps them understand it better.

But how can companies help more people at once?

That’s where insurance chatbots come in. Chatbots can answer many questions people have about insurance. If someone has a question, they can ask the chatbot anytime and get a quick answer. Chatbots can even explain tricky insurance topics in simple ways. This means customers can learn about insurance anytime they want.

- Opportunity to Cross-sell and Upsell

In any business, there’s a chance to offer more products to customers. Imagine your insurance chatbot like a salesperson. After selling house or car insurance, they can suggest other things like life or health insurance. But they’ll only do this if they think the customer might be interested.

Just like that, if your chatbot can give price quotes and advice, it knows a bit about the customer. So, it can suggest other insurance based on what the customer has bought or shown interest in before.

By connecting your chatbot to your customer system and using smart tech, it can guess which insurance the customer might like next. For example, if someone looks at car insurance, the chatbot might suggest house or travel insurance next. Or if they look at health insurance, the chatbot can show options for life insurance and how much they might cost.

With a tool like WotNot, it’s easy to set up your chatbot to suggest different insurance options to customers. This way, the chatbot can offer more products smoothly.

- Receive Feedback and Complaints

Every business likes getting feedback, but not all customers want to give it. It can be hard to get people to share their thoughts. But insurance chatbots can help with this.

When someone is chatting with the bot, it can ask for feedback right there. This helps you see if the chatbot is doing a good job and where it might need to be better.

Chatbots can make giving feedback easy and quick. They can have:

Star ratings

Thumbs up/thumbs down buttons

Quick surveys

Scales to pick from

A place to type out thoughts

Also, if someone has a problem, they can tell the chatbot. The chatbot can then create a note for a real person to help fix the issue. This way, problems get noticed and solved faster.

Final Thoughts:

Chatbots are getting better every day, and they’re bringing new possibilities to the insurance world. We’re just scratching the surface. As AI and Machine Learning grow, there will be even more ways chatbots can help in insurance.

Many companies are already using chatbots in insurance, showing it’s a growing trend. If you’re interested in trying it out, you can start with BharatBot and create your own insurance chatbot.